How Legal Solutions Can Aid You in Coverage a Foreign Gift: Key Truths and Insights

Guiding with the intricacies of reporting international presents can be daunting for individuals and organizations alike. Lawful solutions offer necessary experience in comprehending the detailed guidelines that govern these deals. They assist determine potential threats and create customized conformity techniques. Numerous still deal with difficulties in ensuring adherence to these demands. This prompts the inquiry of exactly how effective lawful support can absolutely boost compliance and reduce risks related to foreign gift reporting.

Recognizing the Lawful Framework Surrounding Foreign Present

While the approval of foreign gifts can boost international relations and foster collaboration, it additionally increases complex lawful considerations that institutions need to navigate. The legal framework governing foreign gifts incorporates different laws and policies, which can vary markedly throughout jurisdictions. Organizations have to know guidelines worrying the disclosure, appraisal, and possible taxation of these presents.

Compliance with federal regulations, such as the Foreign Representatives Enrollment Act (FARA) and the Greater Education And Learning Act, is crucial for companies obtaining considerable international contributions. These legislations aim to guarantee transparency and stop undue influence from international entities.

Additionally, institutions have to think about honest guidelines that control gift acceptance to preserve honesty and public depend on. By comprehending these lawful ins and outs, companies can better manage the risks linked with foreign gifts while leveraging the opportunities they offer for international collaboration and collaboration.

Trick Coverage Requirements for Individuals and Organizations

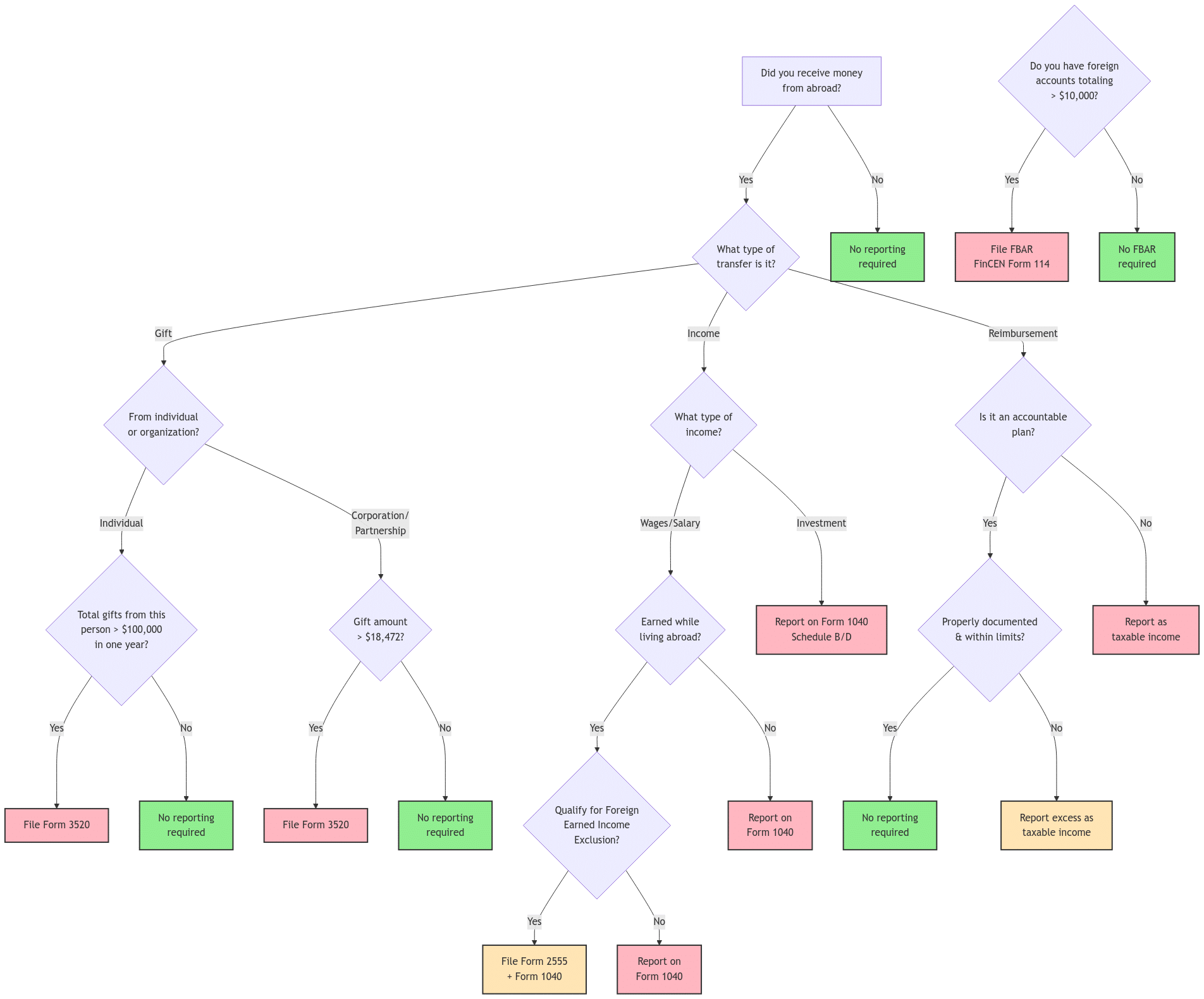

Organizations and people obtaining foreign gifts should stick to specific reporting requirements to assure compliance with lawful responsibilities. These requirements differ relying on the territory and the nature of the gift. Typically, recipients are mandated to disclose international gifts surpassing a certain financial limit to relevant government firms. This may consist of thorough info regarding the donor, the value of the present, and its designated use.

In the United States, as an example, the Foreign Brokers Registration Act (FARA) and the College Act enforce unique reporting standards - report a foreign gift. Establishments have to make sure that their reporting lines up with suitable laws to stay clear of penalties. People might additionally need to report presents gotten in their capacity as public authorities or employees

Comprehending these demands is vital, as failure to report suitably can result in legal effects. Consequently, appealing legal solutions can help with conformity and help navigate the intricacies of international gift reporting.

Usual Compliance Difficulties and Just How to Get over Them

Maneuvering the complexities of international present coverage usually provides substantial conformity obstacles for recipients. One usual issue is the ambiguity bordering the meaning of a "international present," which can cause unpredictability about what should be reported (report a foreign gift). Differing state and federal guidelines can make complex adherence to reporting requirements, especially for companies running throughout territories. Receivers might additionally fight with maintaining accurate documents, as failing to record gifts correctly can lead to non-compliance

To conquer these challenges, recipients ought to establish clear inner plans regarding international presents, making certain all team are trained on compliance requirements. Normal audits of gift records can help recognize discrepancies early. Additionally, looking for support from compliance professionals can offer clarity on subtleties in guidelines. By proactively resolving these hurdles, receivers can better browse the reporting process and decrease the danger of charges related to non-compliance.

The Role of Legal Provider in Navigating Foreign Gift Regulations

Steering with the intricate landscape of international gift laws can be daunting, specifically offered the prospective lawful ramifications of non-compliance (report a foreign gift). Lawful solutions play a vital role in assisting individuals browse around these guys and companies you can try these out through this complicated surface. They provide professional evaluation of the suitable policies, ensuring clients totally recognize their responsibilities pertaining to foreign presents. On top of that, lawyers assist in identifying possible dangers and liabilities related to non-disclosure or misreporting

Finest Practices for Ensuring Conformity With Foreign Present Coverage

Compliance with foreign gift reporting requirements necessitates a positive strategy to stay clear of potential risks. Organizations needs to develop a clear plan detailing the requirements for determining and reporting foreign presents. Normal training for staff associated with the approval of presents is vital to assure they recognize reporting obligations and the implications of non-compliance.

In addition, keeping in-depth documents of all international gifts got, including the donor's function, value, and identification, is crucial. Organizations must apply a testimonial procedure to examine whether a present certifies as reportable.

Engaging legal services can additionally boost compliance initiatives, supplying advice on intricate policies and prospective exceptions. Frequently reviewing and upgrading internal plans according to governing adjustments will assist companies continue to be compliant. Lastly, cultivating a business society go right here that focuses on openness in gift approval can mitigate dangers and improve responsibility.

Frequently Asked Questions

What Kinds Of International Presents Call For Coverage?

International presents requiring reporting usually include considerable monetary payments, residential or commercial property, or benefits obtained from foreign entities, governments, or people, specifically those exceeding specific financial thresholds established by policies, demanding transparency to stop prospective problems of passion.

Are There Charges for Stopping Working to Report a Foreign Present?

Yes, there are penalties for stopping working to report an international present. The effects can consist of penalties, lawful action, and potential damage to an individual's or company's track record, stressing the relevance of compliance with coverage requirements.

Can I Get Legal Help for Foreign Gift Reporting Issues?

Legal aid might be offered for people facing difficulties with foreign present reporting problems. Qualification often relies on monetary requirement and certain scenarios, motivating potential receivers to get in touch with neighborhood legal help organizations for aid.

Exactly How Can I Track Foreign Present Obtained Over Time?

To track international presents gradually, individuals ought to maintain thorough records, including sources, amounts, and dates. Consistently reviewing financial statements and making use of tracking software can enhance accuracy and streamline reporting responsibilities.

What Paperwork Is Needed for International Present Coverage?

Documents for international present reporting normally includes the donor's info, present value, date obtained, a description of the gift, and any appropriate communication. Precise documents ensure conformity with coverage needs and aid protect against potential legal problems.

Organizations and individuals obtaining foreign gifts need to stick to certain coverage demands to ensure compliance with legal obligations. Navigating through the elaborate landscape of international gift laws can be intimidating, particularly given the prospective legal implications of non-compliance. By leveraging legal services, clients can browse the details of foreign gift regulations extra successfully, consequently decreasing the threat of fines and fostering conformity. Legal aid might be available for individuals encountering challenges with international gift reporting concerns. Documents for foreign present reporting typically consists of the benefactor's details, gift value, date got, a summary of the present, and any type of pertinent communication.